The new Bitcoin Quadrennium

The first thing you need to know — Bitcoin halving is a predetermined event whose main visible outcome is the hype around it, which helps the protocol promote itself. That is why you are reading this article. This is also an opportunity for those involved in Bitcoin to expand their audience and reach new people who think the movement around Bitcoin is over. Hats off to the people who created this mechanism; bravo!

Now, what is Bitcoin halving? You can read about it from various sources. We will not dwell on it in detail. In short, Bitcoin halving occurs every four years (or every 210,000 blocks mined), and the reward miners receive for validating transactions is cut in half. In 2024, the block reward will drop from 6.25 BTC to 3.125 BTC per block mined. This mechanism is part of Bitcoin's design to control its supply, gradually reducing the rate at which new bitcoins are created as it approaches its maximum supply limit of 21 million coins. Halving will continue till approx. 2041, when all the Bitcoins are mined. There are not many examples of processes similar to halving from the real world. Rather distant ones, we can cite price control mechanisms by oil cartel or the mining of precious metals. It's somewhat possible to increase oil production and gold mining — but not Bitcoin mining.

What else?

Let's step into a speculative area. Each attempt at future prediction is speculative only if not built into the blockchain protocol design. :D

- Some miners may be forced to shut down their operations because of declining or lost profits. Until yesterday, all miners earned 900 Bitcoins daily; from now on, they will earn twice as little.

- Bitcoin's deflation could also push its price to new maximums, as it has in the past. If operators are also Bitcoin holders, the increased price of Bitcoin could mean more investments in new installations. Do you save any Bitcoin in your account month after month as a BATM operator? MicroStrategy now holds more than 214,000 BTC. Think about that. Maybe Michael Salor is not as insane as it looks from the fiat-world side?

- It's not directly attached to Bitcoin Halving, but the upcoming months hide something more. After the community realized the hidden power of second-layer solutions on the Bitcoin blockchain, the Ordinals came in, and now — the Runes, all from the same creator. All these spam "inscriptions" caused a queue of transactions, increasing the memory volume needed to store the blockchain and one more unpleasant result — higher transaction fees. This will happen again soon, as this new "spam production" protocol will appear right after April's halving.

- Higher transaction fees may deter some users from adopting Bitcoin, who don't see it as a long-term investment but will see it as a slow and expensive form of entertainment. Here is another second-layer protocol that can show itself from the best side—Bitcoin lightning could become more important to the industry and people.

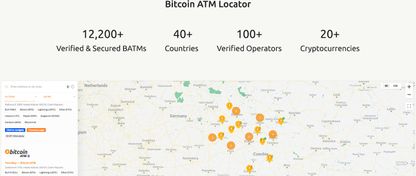

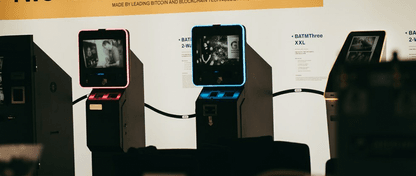

- To mitigate the impact of higher Bitcoin network transaction fees, Bitcoin ATM operators may start integrating or relying more heavily on the Lightning Network, partner with non-custodial wallets, and, if not already, start using Bitcoin batching.

Finally, the main idea we want to end this article with is that as a Bitcoin ATM operator, you must be willing to adjust your business model over time to meet changing environments and circumstances. As a leading Bitcoin ATM manufacturer, we are committed to the same approach. And remember — we are always here to help.

* The views expressed in this article are the author's own and do not necessarily reflect the perspectives of all our team members.